REIMAGINE YOUR INVESTMENT APPROACH

Together, we’ll help you define your ideal investment approach that best aligns with your strategic savings goals today while keeping an eye toward the future.

If you are ready to get started with a financial advisory firm that you can trust, contact CORDA Investment Management, LLC, today at 855.439.0665 to schedule your first appointment.

Barron’s 2025 Top Financial Advisors as of March 11, 2025. Forbes Top Wealth Advisors as of 2024 & 2025.

Third-party ratings and recognition from rating services or publications are no guarantee of future investment success. Working with a highly-rated adviser does not ensure that a client or prospective client will experience a higher level of performance. Generally, ratings, rankings and recognition are based on information prepared and submitted by the adviser.

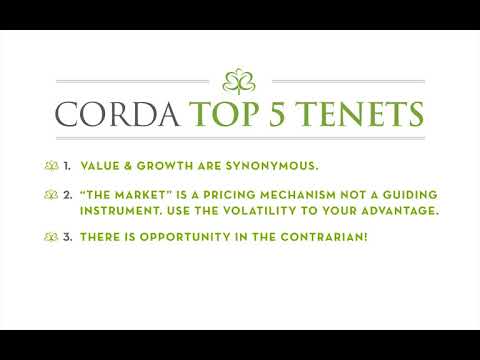

WATCH OUR VIDEOS

READY TO START A CONVERSATION?

Call us at 855.439.0665 or send us a message below.